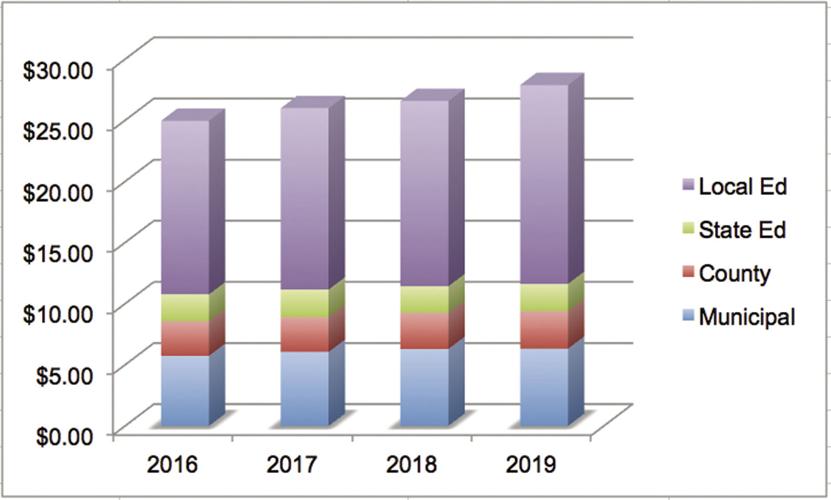

CANTERBURY — The 2019 property tax rate, as set by the New Hampshire Department of Revenue Administration, is $27.87 per $1,000 of assessed valuation, an increase of $1.30, or 4.89 percent, from the 2018 tax rate of $26.57.

It continues a trend that has seen the tax rate rise $2.92, or 11.7 percent, since 2016 when the tax rate was $24.95 per $1,000.

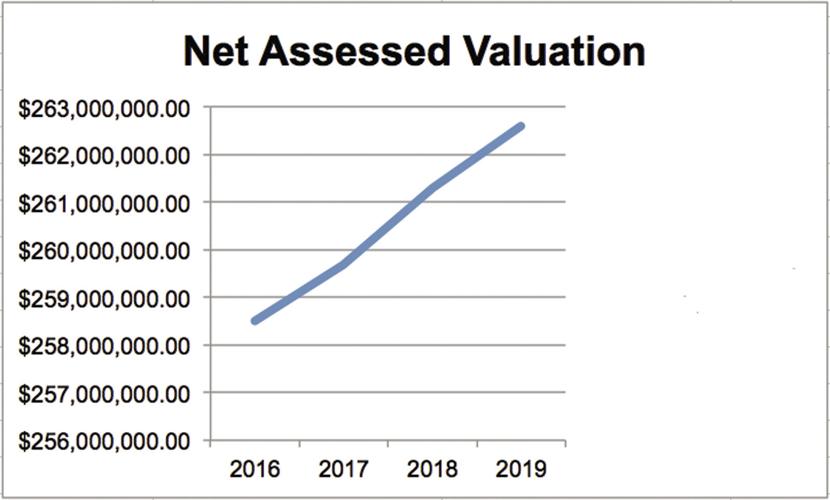

At the same time, the town’s total net assessed valuation of $262.6 million has increased by $1.3 million since 2018 and by $4.1 million since 2016, which compounds the effect on the tax bill.

A hypothetical $200,000 home that paid $5,314 in taxes in 2018 might be valued at $201,000 today, and would have a tax bill of $5,601.87, a 5.4 percent increase.

This illustration does not take into account the new construction that contributes to the town’s net assessed valuation, and individual properties values would vary, based on the type of structure, location, and other factors.

The municipal portion of the tax rate increased by three cents, from $6.29 per $1,000 in 2018 to $6.32 in 2019.

The county tax rate rose 10 cents, from $2.96 per $1,000 in 2018 to $3.05 in 2019.

The state education tax rate increased by seven cents, from $2.17 to $2.24.

The biggest increase came in the local education tax, which rose by $1.10, or 7.26 percent, from $15.16 to $16.26. Belmont — the other community in the Shaker Regional School District — experienced a $2.08 per $1,000, or 13.02 percent decrease on its local education tax rate.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.