MEREDITH — Meredith voters will decide on 19 warrant articles, several of which deal with the municipal zoning ordinance.

Town Meeting is 7 p.m. on Wednesday, March 12, at Inter-Lakes High School.

Warrant Article 5 addresses short-term rentals and would make minor but important changes to the rules governing their use and operation.

“There was a committee of resident volunteers that evaluated the short-term rental market in Meredith” regarding data and impacts, Planning Director Angela LaBrecque said Wednesday afternoon.

Zoning ordinance changes addressed in Article 5 were driven by public input, including survey responses. Citizens met often for a year in considering the ordinance.

“We just tightened it up a bit, made it more specific,” LaBrecque said.

A core component of the proposed change is to specify differences between owner-occupied dwellings and owner-not-occupied dwellings relative to the number of days each year they’re allowed to be listed for short-term rental.

“This amendment is the result of the Short-Term Rental Committee’s effort to reduce the number of commercial-interest, short-term rental properties in residential zones and the associated potential negative impacts,” selectboard Vice Chair Jeanie Forrester wrote in a recent column in The Laconia Daily Sun.

Currently, there is no distinction — owners can rent their dwellings out for 120 days each year. If the change to the zoning ordinance is passed at Town Meeting, owner-not-occupied dwellings could be rented out 90 days per year, and owner-occupied dwellings could be rented out for 120 days. Short-term rentals are an accessory use of a detached single-family dwelling for periods less than 30 consecutive days.

Owner-not-in-residence refers to properties owned by an individual who lives somewhere else, and owner-in-residence refers to properties where a portion may be rented out while another is occupied by the owner.

The proposed changes also set limits on occupancy of short-term rental properties, meant to prevent the overloading of infrastructure, such as septic systems. New limits would include one car per available bedroom, two individual people per bedroom plus an additional two people.

Accessory apartments or accessory dwelling units, also known as ADUs, are not permitted to be used as short-term rentals.

“The selectboard believes the proposed ordinance will provide significant improvements in short-term rental compatibility with our traditional residential neighborhood environment and urge a positive vote on March 11,” Forrester wrote.

Other articles, such as Article 2, would make minor changes to the zoning ordinance. Article 2 would remove the requirement for a small single-family dwelling, such as a camp, to have at least 500 square feet of foundation on the ground.

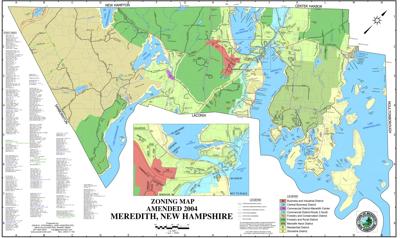

Warrant Article 3, also a proposed change to the municipal zoning ordinance, would allow multi-family use by right rather than by special exception in certain areas of the town. Zones included in the list for the change are in areas where apartments are already common. This procedural change would allow a property owner to construct an apartment without going before the town Zoning Board of Adjustment. An applicant would still need to go before the planning board for a site plan.

Warrant Article 4, another potential amendment to the zoning ordinance, would allow the development of ADUs “by building permit” rather than by special exception in certain areas of the town.

ADUs would still be required to satisfy the same specific criteria, not exceeding 1,200 square feet or two bedrooms and sewage rules, for example. It would also change the requirement that an ADU has to be within 100 feet of the home, extending the distance to 150 feet.

Meredith residents will also vote on aspects of the town’s 2025 budget, such as in Warrant Article 7. The proposed operating budget for the town is $21 million for general municipal operations, a 4.7% increase over 2024. The estimated new tax rate is $3.76, up $0.41 from the 2024 New Hampshire Department of Revenue Administration completed tax rate.

To read all the articles on the warrant, visit meredithnh.gov/DocumentCenter/View/737/2025-Warrant-Articles.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.