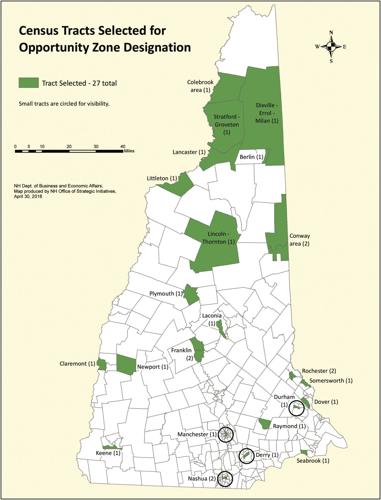

LACONIA — New Hampshire Gov. Chris Sununu yesterday nominated part of the city of Laconia, including the old State School property, as one of 27 low-income areas statewide to participate in a federal economic development program.

Other areas selected for the Opportunity Zone program include tracts in Plymouth, Franklin, Lincoln-Thornton and Conway.

“Opportunity Zones provide tax incentives to investors to reinvest unrealized capital gains into neighborhoods throughout the state,” Sununu said. “These local neighborhoods deserve an economic boost, and that is what we are going to give them.

“The goal is simple: to create jobs, to increase wages, and to revitalize communities across the state.”

Taylor Caswell, commissioner of New Hampshire Business and Economic Affairs, said only 25 percent of the state’s low-income census tracts could be nominated for the program, so officials had to select areas with the most potential for investment.

“My hope is that once this program is fully deployed, it can serve as catalyst to bringing economic opportunity to New Hampshire communities,” Caswell said.

The section of Laconia that includes the old State School property is an obvious choice for the program. A state board is examining the best way the state-owned land near the intersection of North Main Street and Meredith Center Road could be developed as a jobs generator.

The Laconia census tract being nominated for the program is bound on one side by Route 106 and on another by Winnisquam Lake. It also takes in a wide area to the north of the old State School that is being eyed by city planners for potential infrastructure improvements and residential development.

Justin Slattery, executive director of the Belknap Economic Development Corporation, said the program could be helpful for the city as it looks to grow.

“I’m glad to see Laconia is part of the designation,” he said. “It’s another tool we can use to drive investment and economic development.

“It’s a resource we can potentially use on future projects.”

The Belknap EDC is putting together the financing package for the Colonial Theatre revitalization project downtown, which includes significant federal tax credits.

The Opportunity Zone program was established under last year’s Tax Cuts and Jobs Act. Investors can defer capital gains on earnings reinvested in the zones, and long-term investments maintained for over 10 years do not have to pay additional capital gains taxes on earnings from Opportunity Zone investments.

Sununu spoke about the program in the Franklin Opera House.

“New Hampshire’s resiliency lies in our local communities – they are the backbone of our society and the focal point of cultural activity,” he said. “For far too long, however, some neighborhoods have been left behind. While some have thrived in recent years, others are struggling to keep up.”

Final designation of Opportunity Zones are subject to federal confirmation. Final rules for the program are being developed by the U.S. Treasury.

Communities being nominated for Federal Opportunity Zones:

• Berlin

• Claremont

• Colebrook, Atkinson and Gilmanton Grant

• Conway/North Conway

• Derry

• Dixville Notch, Columbia, Millsfield, Errol, Dummer, Milan, Cambridge, Success, Erving and Wentworth’s location, Second College Grant

• Dover

• Durham

• Franklin

• Keene

• Laconia

• Lancaster, Kilkenny

• Lincoln, Easton, Waterville Valley, Livermore

• Littleton

• Manchester

• Nashua

• Newport

• Plymouth

• Raymond

• Rochester

• Seabrook

• Somersworth

• Stratford, Groveton (Northumberland), Stark, Odell

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.