BELMONT — This year's tax bills, with a new tax rate of $17.39 per $1,000 of assessed valuation, have already been mailed to all town households, and were due Dec. 16.

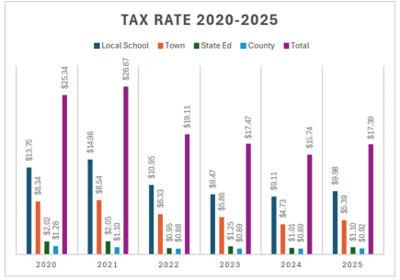

This is a 10.5% increase, or $1.65, from the 2024 rate of $15.74, and is one of the highest rates in the Lakes Region, according to the New Hampshire Department of Revenue Administration's website. The rate is similar to 2023, which was $17.47.

"The 2025 tax rate increase was driven by higher operating costs, inflation, contract obligations, and the need to maintain essential public services that residents depend on every day, including public safety, schools, road improvements, and much much more," wrote Town Administrator Alicia Jipson in an email. "While no increase is taken lightly, we are always mindful of the impact on residents when creating budgets; these adjustments are necessary to ensure continued service levels and long-term financial stability."

According to town leaders, the local and state education tax rate combined is 63.7% of the total value, with the local school rate at $9.98, and the state education rate at $1.10.

The county tax rate is $0.92, or 5.29%. The municipal tax rate is the only rate the Town of Belmont has control over. That number came in at $5.39, or 31%.

The past five years have demonstrated a decrease in the total rate, which was $25.34 in 2020.

The rate was set Nov. 7, and tax bills were mailed by Nov. 14. The town’s assessed valuation including utilities is $1.5 billion.

For those who haven't paid their tax bill yet, it's important to do so, since it helps the town continue to conduct business.

"Paying property tax bills on time is especially important, as it allows the town to meet its obligations, avoid additional borrowing costs, and to continue providing reliable services for all residents," Jipson wrote.

Town Clerk and Tax Collector Jennifer Cashman agreed.

"Paying property taxes is essential to keeping our community running," Cashman wrote in an email to The Daily Sun. "These funds support important local services such as schools, public safety, road maintenance, and emergency response. Paying the property tax bills on time ensures that the town has the necessary funds it needs to operate the town in a manner that it planned during planning of the budget."

Tax bills can be paid online at belmontnh.gov, along with dog licenses, utility bills and car registrations.

"Payments can be mailed in, or dropped in the drop box located in the front door of our building and as always, people can come in person and see our smiling faces," Cashman wrote.

•••

Katlyn Proctor can be reached at katlyn@laconiadailysun.com or by calling 603-524-0150.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.