FRANKLIN — Monday night’s community forum, sponsored by Franklin Developments and taking place at the Franklin Lodge of Elks, gave residents a chance to ask questions about the city’s proposed whitewater park, while supporters dispelled some of the misconceptions about the project that have spread on social media.

According to a video recording of the meeting, there was overall support for Mill City Park, but some residents were skeptical about the financial projections and worried that taxpayers would end up having to pay for additional police and medical services as a result of the influx of young adventurers. Potential liability for injuries and the impact on traffic were other concerns that people raised.

Marty Parichand, the owner of Outdoor New England who spearheaded the effort to create the first whitewater park in the Northeast, explained the scope of the project and what it could mean for Franklin.

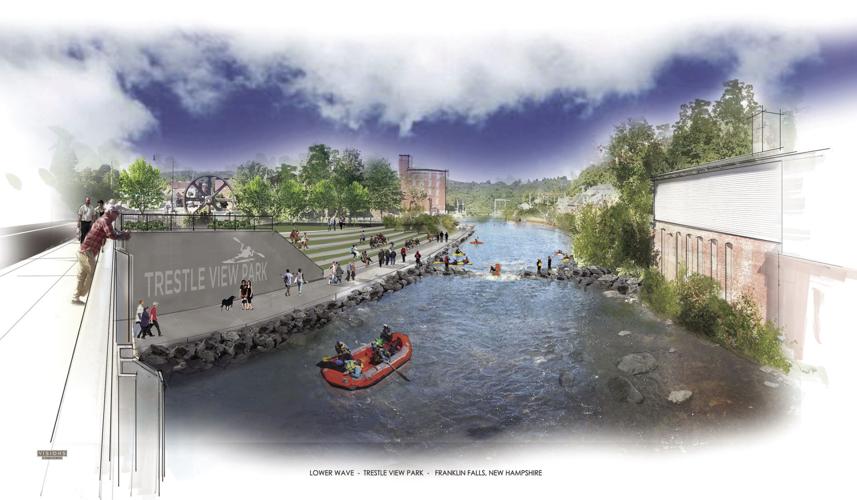

Mill City Park, which has obtained a nonprofit designation which allows for tax-deductible support, is working with the city of Franklin to refurbish the train trestle that spans the Winnipesaukee River in downtown Franklin. Supporters also want to create stadium seating in Trestle View Park, create a multi-use trail on the eastern side of the river, with a new park that will feature picnic tables, create additional off-street parking, and offer camping.

Plans also call for improvements to the upriver sulphite bridge — known as the “upside-down bridge” — to allow pedestrians to cross between the new trail and the existing Winnipesaukee River Trail.

The main feature will be the river itself, which once supported a number of factories because of its steep descent — 70 feet per mile. Engineers will be designing “features” for boaters by reshaping the riverbed, removing debris left over from the old mills, and taking advantage of even low flows to offer something “every day of the week, all year ‘round,” Parichand said.

Videos from other whitewater parks showed how kayakers and surfers can use man-made features to practice their skills. Parichand pointed out that, unlike the ocean, the river currents provide stationary features so a paddler or surfer can work out in one point of the river.

When members of the audience questioned the plan to change the natural flow of the river, Parichand pointed out that, with the remains of the mills that had collapsed or been dynamited in the past, “There’s nothing natural about that river.”

Tax impact

Because of the city’s partnership with Mill City Park and other developers who anticipate a revitalized Franklin, some residents worried that the city was spending money on a dream that might not materialize.

City Manager Judie Milner explained that the project is relying on grants for funding, and the city’s role is only to act as a facilitator for the grants. It will not create a need to raise taxes, she said, and, in fact, will generate investment in the city that will increase the tax base. One investor alone will bring an additional $600,000 in tax revenue when the project is complete, she said.

Responding to questions about the need for additional police or fire personnel, Milner said the city already has the trained staff needed because of those already using the river. As for potential liability to the city, she said public parks are protected by law.

A resident who complained about detoured traffic during Winni River Days, when Central Street was closed for activities on the river, said cars were speeding by his home on a dead-end street, thinking they were using a short-cut.

Milner said that the city had not done a good enough job in planning the detour for that event and said they learned from the incident. There will be more signs and clearer directions for future shutdowns, she said.

Parichand said only one event a year would require shutting down the main street, and the additional parking lot will alleviate some of the traffic woes.

Jim Aberg of the Franklin Business and Industrial Development Corporation explained the tax credit program that has been approved for Franklin. Businesses can purchase the tax credits to reduce their business tax liability and direct the money to the local economy. The New Hampshire Community Development Finance Authority awarded $500,000 in business tax credits to the Franklin project.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.